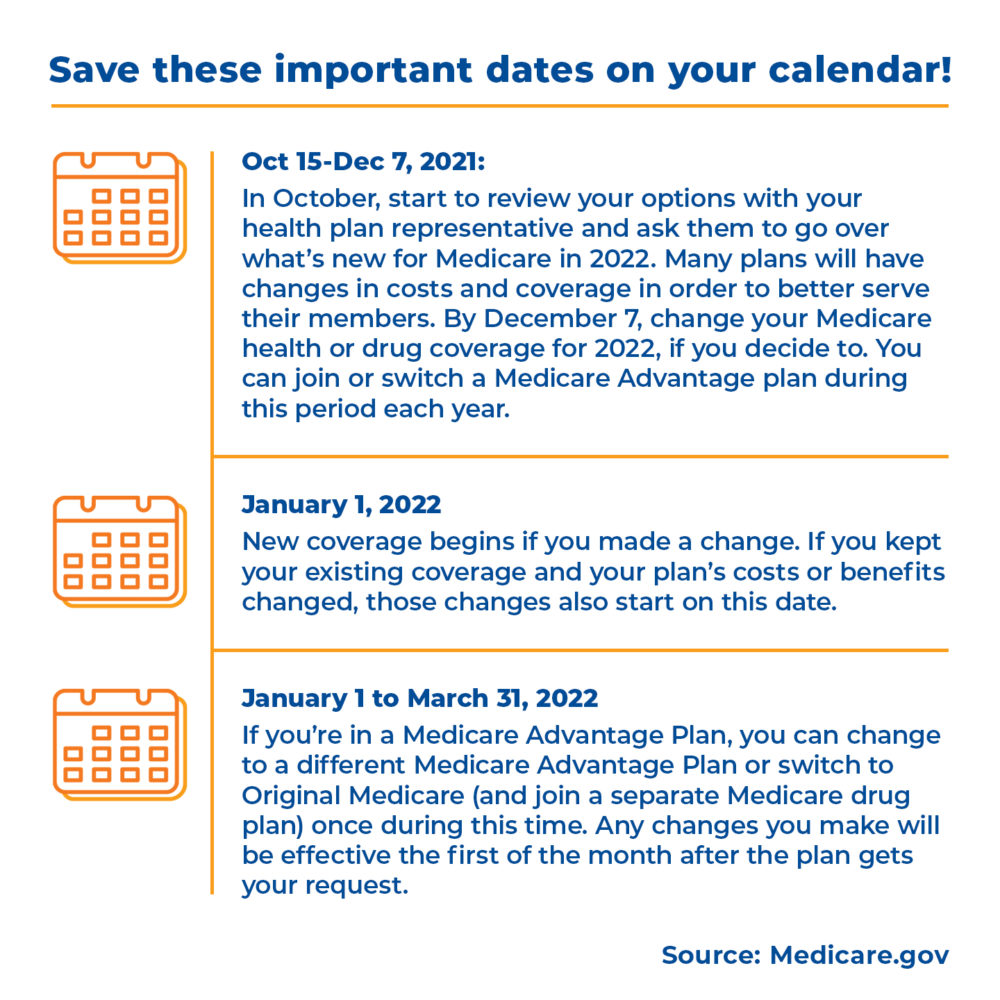

If you are nearing age 65 or are already enrolled in a Medicare plan, chances are you are seeing a lot of mail and TV commercials about the Medicare Annual Enrollment Period (AEP) these days. It can be a confusing time but here’s the good news: AEP is a great reminder to review your Medicare Advantage or Original Medicare plan so you can make sure you have the coverage you need. If you’re happy with your current plan, there’s no need to do a thing. It automatically renews on January 1, 2022. But consider if there have been any changes in your health, lifestyle or budget this year. Your own plan may look different than it does today so you just want to make sure it’s still serving your needs.

Questions to ask your health plan representative or broker during AEP

1. Did my monthly premiums increase?

Compare your current plan premium to the premium amount shown on your Annual Notice of Change letter you should have received in September. You are likely to see a slight increase in premiums regardless of your plan, but if you see a significant increase it might be time for a change.

2. Are my prescriptions still listed on my drug formulary?

Each year there is a chance that changes will be made to your drug formulary, the pricing tiers that medications are placed in, or the copays required for various types of prescriptions. Additionally, now that some Medicare Advantage prescription drug plans require prior authorization for select pricey brand-name drugs, it can become more difficult to get them covered by your plan. You’ll want to find out if your current prescription plan will cover your current medications in the upcoming year, and how much you’ll pay for them.

3. Is my doctor still in my plan’s provider network?

Since Medicare Advantage plans’ network of doctors can change each year, it’s important to confirm that your current doctors will still be covered the following year. If they are not, you may want to consider changing providers since you’ll be paying much higher out-of-pocket costs to stay with the same doctors. Work with your health plan representative to find the right doctor for your needs.

4. What are my predicted annual medical costs?

Put together a list of expected doctor visits and procedures you’ll need over the next year and estimate what that will cost out of pocket with your current Medicare plan. Then, add in what you’ll pay in premiums and that will give you an accurate estimate of your healthcare costs in 2022. This is a good exercise to do with the alternative Medicare plans you’re considering in order to compare total expected costs.

5. Does my coverage include vision, dental, and hearing benefits?

Medicare doesn’t cover routine dental, vision, and hearing services, but some Medicare Advantage plans do. Another option is enrolling in a stand-alone dental, vision, or hearing plan to add on to your Original Medicare and/or Medigap benefits to give you additional coverage.

Use this Annual Enrollment Period as an opportunity to make sure you’re getting the care you deserve. Contact your health plan or broker to ask these important questions and learn more today!

The information included in this blog is for educational purposes only and is not intended to be a substitute for professional medical advice.